According to the established international standards, an airport's catchment area is determined as including all points within the territory from which the airport can be reached in a given amount of time using any means of transport available. The Milan airport system's catchment area principally comprises, in declining order of attractiveness, the Milan metropolitan area, the Region of Lombardy and north-western Italy. It also extends – albeit with a lesser ability to capture demand – to the regions of north-eastern Italy, Emilia Romagna and Tuscany. Within the Milan airport system, Malpensa is one of two airports in Italy (the other is Rome Fiumicino) serving a significant network of long-haul destinations. Accordingly, passengers from northern Italy who wish to travel to intercontinental destinations have two choices: travel from Malpensa or depart from the nearest regional airport and change planes at a European hub. Italy's National Airport Plan also classifies Venice airport as strategic, but its network of long-haul destinations is not currently comparable to Malpensa's.

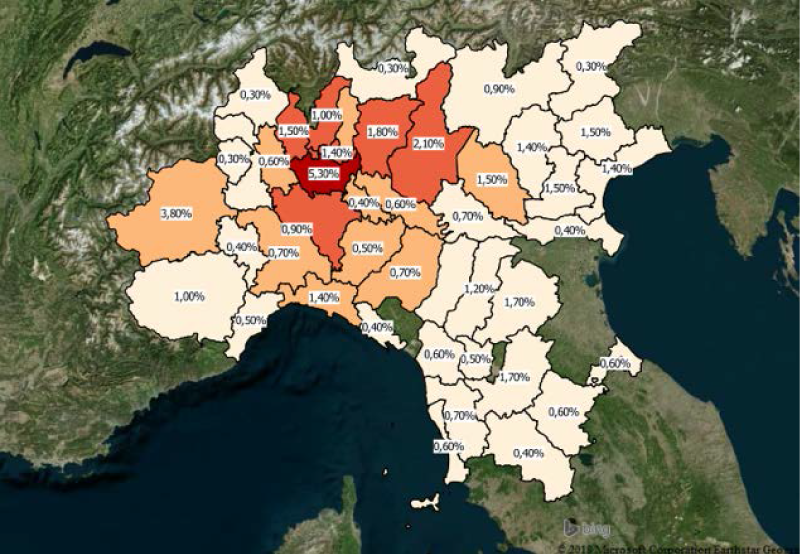

Malpensa airport's catchment area

Population percentage of the provinces in Malpensa airport's catchment area compared to the total population.

Source: Prepared by SEA using CLAS 2016 and ISTAT survey data

In the short and medium term, it can therefore be stated that all of northern Italy is a potential catchment area for Milan's airports, and in particular for Malpensa with regard to long-haul destinations. The ability to channel demand to Malpensa rather than to connecting flights routed through other European hubs is contingent on the accessibility of Malpensa airport – an area in which a fast, integrated and effective road system can make the difference.

Linate airport's catchment area

Population percentage of the provinces in Linate airport's catchment area compared to the total population.

Source: Prepared by SEA using CLAS 2016 and ISTAT survey data

Socio-economic features of the Milan airport system catchment area

| Catchment area | % of Italian total | |

|---|---|---|

| Area (km2) | 135,057 | 44.8 |

| Population | 29,676,146 | 49.06 |

| GDP 2012 (Euro mil.) | 910,053 | 58.1 |

| N° companies 2015 | 2,652,848 | 56.6 |

| N° employees 2015 | 10,050,207 | 61.7 |

| Exports 2016 (Euro mil.) | 333,200 | 79.8 |

Source: Prepared by SEA on ISTAT data

Lombardy – among Europe's most competitive regions – is the heart of the Milan airport system's catchment area.

Competitiveness of the airport and its local community

Airports and the communities in which they are located have a mutually reinforcing influence on one another: airports can have an impact on the competitiveness and economic development of the communities that benefit from their presence, yet the social and economic context in which airports operate also has a significant effect on airport operating performance. The type and scope of the effects that our airports have on the social and economic parameters of the community in the catchment area (understood in its various ramifications, as discussed in the section above) are described in the section of this document dedicated to social and environmental impacts. On the other hand, the contextual factors that have a particularly significant impact on the scope and characteristics of the airport business include economic growth (which has an impact above all on outgoing air traffic) and the attractiveness of the local area, above all to tourists (which instead affects incoming traffic).

The economic background of Lombardy and Milan

Lombardy6 is Italy's number-one region from both a demographic and economic standpoint. Its population of 10.0 million at January 1, 2018 accounted for 16% of the nationwide total and its GDP, which exceeded Euro 383.2 billion in 20177, represented 22.2% of the Italian total.

| Lombardy | Italy | Share | |

|---|---|---|---|

| Area (sq. km) |

23,864 | 302,073 | 7.9% |

| Population (1/1/2018) |

10,036,258 | 60,483,973 | 16.1% |

| Forza lavoro (thousand, 2017) |

4,701 | 25,930 | 18.1% |

| GDP (nominal, mln €, 2017) |

383,175 | 1,724,955 | 22.2% |

| Valore aggiunto (pro capita, 2017) |

34,064 | 25,550 | - |

| Enterprises (2017) |

815,956 | 5,150,149 | 15.8% |

| R&D expenditure (mln €, 2016) |

4,758 | 23,172 | 20.5% |

| Import (mln €, 2017) |

124,737 | 400,659 | 31.1% |

| Export (mln €, 2017) |

120,334 | 448,107 | 26.9% |

Source: Booklet Italy, Lombardy and Milan: the strengths of our territory - No. 7, January 2019

From the standpoint of economic indicators, Lombardy is the number-two European NUTS2 region in terms of GDP generation, following Île de France but coming in ahead of regions such as Inner London, Upper Bavaria, Düsseldorf or the Stuttgart region.

In 20178, Lombardy’s workforce of 4,701 thousand workers accounted for 18.1% of the national figure. The number of employed workers, equal to 4,701 thousand, represented 19% of the national figure. The employment rate (the ratio of employed workers to the population between ages 15 and 64) was 64.9%, well above the national average of 55.7%, and, with reference to the Four Motors of Europe, better than in Catalonia, although lower than the average of the Baden-Wüttemberg and Rhône Alpes regions.

A large number of companies operate in Lombardy, with as many as 97,220 dedicated to manufacturing, and a total of 815,956 registered with the Chamber of Commerce in 2017, accounting for 15.8% of all Italian companies. Around 1,000 medium-sized manufacturing companies are spread across its territory, while 250 are based within the City of Milan. These figures respectively account for 31% and 7% of the 3,300 medium-sized manufacturing enterprises active in Italy9.

The territory of Milan is also the managerial, administrative, commercial or operational home to over 4,200 multinational companies (32.4% of all those operating within Italy as a whole), which collectively generate a turnover of Euro 208 billion and employment for 431,072 workers.

Main trading partners in Lombardy

| Export 2017 | % change 2017-2018 | |

|---|---|---|

| Germany | 16,093 | 12.7% |

| France | 11,782 | -3.3% |

| USA | 9,049 | 54.0% |

| Spain | 6,678 | 3.2% |

| Switzerland | 6,497 | 29.8% |

| United Kingdom | 5,408 | 14.4% |

| China | 3,950 | 64.5% |

| Poland | 3,567 | 35.9% |

| Netherlands | 2,906 | 10.7% |

| Turkey | 2,737 | 34.1% |

Source: Booklet Italy, Lombardy and Milan: the strengths of our territory - No. 7, January 2019

The degree of internationalization of the Lombard economy and the location of the main markets of interest for local economic operators are significant indicators for the evolution of originating air transport demand.

Though Lombardy’s main trading partners, facilitated by the total value of trade exchanges, reside predominantly in Europe, the last decade has seen a shift in the focus of Lombard companies towards areas of the world with stronger overall growth, evidenced by a net increase in trade relations with the USA (+54.0%) and China (+64.5%).

An even more significant reflection of this evolution can be read in data concerning the repositioning of Milan’s exports on foreign markets.

Over the last 15 years (2003-2017), the Milan area’s production export value has grown by approximately 14.8%, up from Euro 35.9 to 41.2 billion. This growth has been driven mainly by non-European markets, accounting for 61% of trade, up from 45% at the beginning of the period.

Repositioning of Milan’s exports to non-European markets

Source: Booklet Italy, Lombardy and Milan: the strengths of our territory - No. 7, January 2019

Attractiveness of the Milan area10

According to data supplied by the Milan Monitoring Centre, which measures Milan's ability to attract and compete – understood as the city's ability to play a global role, projecting a positive image of itself and drawing people, organized knowledge and capital – Milan is a metropolitan area with a robust, highly diversified economy (ranging from industry to commerce, services and finance); its leadership is strongest in areas relating to business and it enjoys a very positive international reputation.

The analysis was conducted on a comparative basis with the urban centres of the other four major European economic regions: Barcelona, Lyon, Munich and Stuttgart.

In terms of attracting tourists, Milan maintained its third-place ranking in 2018’s Observatory (0.93, slightly below average), after Munich (1.27), which was overtaken by Barcelona (1.33). The latter cities saw a decidedly higher and increasing number of tourist arrivals (11.7 and 16.2 million respectively in 2016, against 6.9 million in Milan’s metropolitan area). Milan came just below the benchmark average in international tourist spending (0.95), topped by Barcelona (1.57) followed by Munich (1.35).

This reflects Milan’s continuing lower share of total tourist spending, despite its growth in average expenditure, up 25% from the previous year (+18% in Barcelona, +65% in Munich). The set of activities grouped under the “leisure” dimension saw Milan (with an average score across all dimensions of 1.16) maintain its second placing after Barcelona (with an average index of 1.62 confirming its leadership of the previous year) but clearly ahead of the other industrialized cities in the ranking: Lyon (0.82), Munich (0.76) and Stuttgart (0.64). However, Milan was the only city to lose points (-0.25) in comparison with 2017’s survey. This loss was concentrated in the “shopping” dimension, where Milan fell to second place (1.33), losing the previous year’s top spot to Barcelona (1.55). This dimension is assessed using three indicators: the top 250 global retailers’ ranking of the 57 most attractive European cities, the cities’ percentage shares of total shopping expenditure by international tourists, and the average of international tourists’ shopping receipts. Milan’s setback was mainly attributable to the second indicator, but not in terms of sales, which are seeing as clear a growth as those of Barcelona, whose market share in relation to the other 5 cities rose from 49.0% in 2016 to 65.3% in 2017. Considering the offer of entertainment and leisure facilities (e.g. libraries, swimming pools, restaurants, bars, nightclubs), Milan (1.11) came in second place after Barcelona (1.51), improving on the previous year’s positioning. The result has less to do with complex infrastructures such as libraries and pools, whose yields tend to be constant over time, but more to do with the dynamism of nightlife venues, which saw the gap between Milan and Barcelona shortening in 2018 compared to 2017.

Attractiveness of the Milan area – benchmark based on various European cities

Source: Based on Milan Monitoring Centre data 2018

The sporting events hosted by the city serve as both a strong draw for international visitors as well as a significant boost for the city's reputation, with an important role to play in gaining the attention of an extremely broad public and worldwide media coverage. In this aspect, Milan (1.53) appears stable in second place following Barcelona (2.42), which continues to grow, while both distance themselves from the other cities in the panel, thanks to continuous strong investment. Milan held first place in the attraction of world-scale events, though was far behind Barcelona in terms of European events. Regarding trade fairs, 2016 saw Milan fall below the benchmark average in comparison to the previous year, while Frankfurt continued to excel (1.25). Milan appears stable in terms of B2B visitors, while slightly increasing the number of international exhibiting companies.

Milan also saw its reputation as a “global city” grow steadily. Among the cities under consideration, not only did Milan gain a considerable lead over the others (1.78, with Barcelona achieving only 0.94), but it was also the only city to improve its reputation compared to the last edition of the Observatory (1.60). This result came from an elaboration of the “World City Network” rankings, measuring the degree of integration of 707 cities within the global economy, and of the Reputation Institute’s “City Rep Track” data, based on the responses of 23 thousand G8 country residents to an opinion survey on 56 world cities. In an increasingly interconnected international context, a direct connection to the world's major cities is indispensable. Access to effective air transport services is thus an essential driver of success.

International accessibility, calculated from intercontinental, continental and passenger airport accessibility indices, saw Milan rank second (1.37) after Munich (1.68), amply overtaking Barcelona (1.13) and distancing itself considerably from Lyon (0.47) and Stuttgart (0.34).

Milan’s weak point continues to be intercontinental accessibility. Milan registered an index of 28.6 (London = 100) compared to Munich’s 43.2, despite its airports moving approximately the same number of passengers (44.0 million against 44.6 in Munich). The percentage of intercontinental flights offered by the first carrier at Malpensa was 9%, compared to 35.4% in Munich. Regarding the other major airport systems, Lufthansa in Frankfurt operated 52.7% of intercontinental flights, Air France in Paris 48.2% and KLM in Amsterdam 44.0%.

A major strength of Milan is its manufacturing sector, which creates value by exporting according to a logic of social and environmental sustainability. This dimension saw Milan in first position (1.77), leading, albeit slightly, Munich (1.70), and by far other cities with great industrial traditions, such as Stuttgart (0.73) and Lyon (0.10). Significantly, it leads as base of operations for companies with a turnover of over Euro 1 billion (90 companies), ahead of Munich (61) and Barcelona (39). Within the group considered, economic power is closely contended by Milan, Munich and Stuttgart, as evidenced by Global RepTrak 100’s listing of the number of companies with registered offices in the cities. The ranking measures the reputation of 100 global companies based on approximately 170 thousand assessments, seeing Milan (1.66), Munich (1.67) and Stuttgart (1.67) practically even. 2018’s Observatory extended the analysis of reputation to sustainability by referencing RobecoSAM’s “The Sustainability Yearbook”, which annually assesses sustainability practices in over 3,400 listed companies. According to this analysis, Milan ranked second (1.67) behind Munich (2.08), but ahead of Barcelona (1.25).

An additional key factor of the global cities' competitiveness is the ability to attract companies and capital in terms of local offices of foreign multinationals. Milan (1.49) is well positioned above the benchmark average, second only to Munich (1.56) at the top of the rankings. Compared to the other cities' roles in their respective countries, Milan is unique in that it acts as a privileged gateway for foreign direct investment in Italy, accounting for 30.8% of all new international greenfield projects.

The last area comparing Milan to the identified benchmarks concerned its attractiveness to talent and human capital. Munich was confirmed as the main centre of attraction for talent (with a score of 1.60), in terms of both foreign university students and researchers funded by the European Research Council. Further confirmation of Munich’s attractiveness was its excellent score as a university town in the QS Best Student Cities index. In the overall ranking, second place was taken by Barcelona (1.15), followed by Milan with the average score (1.00).

6 Source: Confindustria Lombardia; ♯Lombardia 2030

7 Source: ISTAT (dati.istat.it), Gross Domestic Product at market prices, raw data

8 Source: Booklet Italy, Lombardy and Milan: the strengths of our territory – No. 7, January 2019

9 Number of medium-sized manufacturing companies with 50-499 employees, and a sales volume of between Euro 15 and 330 million (excluding subsidiaries of large and foreign corporations)

10 Source: Milan Monitoring Centre 2018